When and How to Open a 2nd, 3rd, 5th or 10th Office

The Pros and Cons of Opening a New Location

When a Solution Provider asks us if and how to open a new location – whether it is their second, third, fifth or tenth – we ask: “What are the goals of the shareholder(s), which have led to considering opening another location?”

The answer most often is, “Growth” although it can also be, “Because our current clients here, have remote offices there.” In that case, there are two purposes:

-

Growth: Use those distant customer offices as a springboard to open a new market, and also,

-

Defense: Defend the customer’s remote offices from poaching by a Solution Provider local to that market.

In either case, opening a new market is an investment and a risk of nearly the same magnitude as starting a new business or making a venture capital investment. It has the potential to create significant additional value, but there is a high risk that it may not, even after significant investment and time. Even large and consistently successful Solution Providers do not open new markets lightly; the failure of a new market can be grounds for senior heads to roll.

In this newsletter, we’ll examine the pros and cons of opening a new market, how to make the decision, and how to mitigate risk. We’ll also outline the best practices for opening and operating the additional location.

Throughout this newsletter, we’ll use Managed Service Providers (MSPs) as our example. However, the best practices cited here apply to Solution Providers in any of the Predominant Business Models™.

Contents

Common Misperceptions About Opening a New Location

In terms of risk and reward, the decision to open a new location is about on par with the decision to buy a company, or to make any other large – possibly “bet the farm” size – investment decision.

Therefore, it merits looking at with a critical eye.

You may wonder if one reason we look skeptically at the prospect of adding locations might perhaps be because we ourselves have not been successful at adding new locations. Rest assured:

-

The first Solution Provider we built, started with one location, grew to nine and was successfully sold to a Fortune 100 company.

-

The second we successfully grew from 14 locations to 44 and over $2bb in Revenue.

-

The third was 14 locations, which was successfully sold to a Fortune 50 company,

-

The fourth was 100% Managed Services which was successfully grown from one to 18 locations.

Some of those plays included buy-side M&A ranging from a few to a handful of deals. Others were M&A-heavy: many sequential acquisitions and integrations. Thus, some new locations we opened were “greenfields” (opening a new office without an acquisition), but others included an acquisition.

We know firsthand the challenges and best practices of opening and operating new locations. We also have seen many attempts by other Solution Providers, including those who later became our clients, at opening new locations which did not go well.

From this experience, we encourage you to examine your reasons and assumptions with a critical eye. Since you may not have that experience, we will provide at least some of the critical eye for you.

The Grass is Greener – Not

Unfortunately, the decision to open a new location is often a case of “the grass is greener.” We can dispense with this false assumption quickly:

- Neither is the new market likely to be any easier to cultivate and harvest than your existing one.

- Nor is it usually the case that you have yet made your existing market fully productive.

- Likewise, it is unlikely that the methods being used in the existing market that are yielding too little growth, will be any more effective in the new market.

These blunt observations may fail to convince the congenitally stubborn and incurably optimistic entrepreneur, so let us examine them in more detail.

How many MSPs are there? In our master database, we have about 34,000 substantive Solution Providers (across all 10 Predominant Business Models), about 80% of whom are in the United States. CRN will tell you they have about 100,000 subscribers in the U.S. Microsoft will tell you they have about 320,000 partners in the U.S. (and another 80,000 worldwide).

Notwithstanding the likelihood than only about 40,000 or so of these U.S. Solution Providers are substantive – larger than 2 or 3 people – these numbers all make the same point:

-

In every market, there are hundreds, if not thousands, of Solution Providers.

-

Yes, not all of them are MSPs: As of the end of 2017, according to our Service Leadership Index® “only” about 33% of them are in the Predominant Business Model™ of Infrastructure Managed Services – our fancy name for MSPs.

-

But many more have at least some Managed Services Revenue and most are trying to grow it.

This puts the number of companies in the U.S. who are materially in the MSP business model at something like 10,000 – 15,000, a number which ties out nicely with the approximate combined license base of the top three Professional Services Automation (PSA) tool vendors.

Example: Recently, for a Private Equity client looking to buy an MSP in what would generally be described as a Tier 3 market (i.e. not in the top 40 markets by population), we found 113 substantive Solution Provider companies of which MSPs made up – you guessed it – about one-third.

In short, there are no underserved markets, at least in terms in number of Solution Providers.

The point being, if the competition in your city is stiff, and you feel you’re running out of leads, keep in mind your peer Solution Provider in the “new” market is likely feeling the same way.

Think about it: If you go to a lot of industry events, you’re probably aware of more competitors in your market than most. Yet you probably can name only a half-dozen or so, and you probably actively compete with fewer.

If you operate in a Top 20 metro by population, our master database will record at least 500 companies there, and perhaps a thousand or more. If you’re in a Tier 3 market there are generally at least a hundred or so, and that’s ignoring the phenomenon we call “Tier 3 Titans”.

The fact that there are so many Solution Providers in your current market, is good news for you, and there are several reasons why.

The Grass is Just as Green Where You Are

The fact that there are so many Solution Providers in your market is good because it means there are many customers! Let’s take MSPs, for example.

-

Over the last five years, again according to the Service Leadership Index, the average Revenue of the companies whose PBM™ is Infra-MS (i.e. MSPs) has risen from about $3.6mm to about $4.7mm.

-

This is Compound Annual Growth Rate (CAGR) of 5.5%. The same average firm has grown its recurring Revenue at a CAGR of 10.9%.

-

Yet there are many more MSPs.

-

And, to the surprise of the Chicken Littles who fret over Managed Services becoming “commoditized” (and no surprise to us by the way):

-

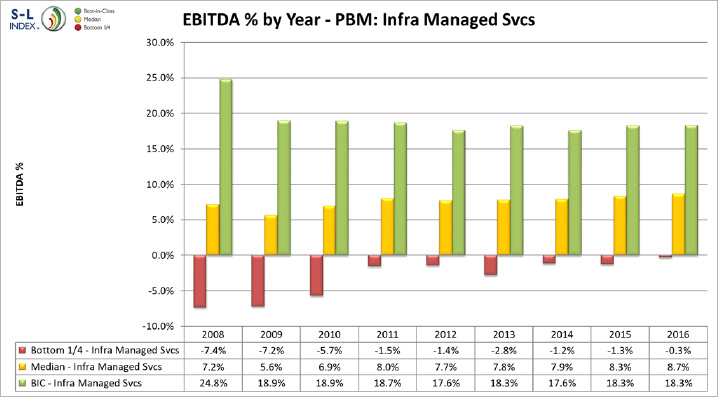

The top quartile EBITDA % over the last nine years has not dropped,

-

The Median EBITDA percentage has actually improved, as has that of the bottom quartile MSPs.

This can be seen in the chart below.

The meaning of this chart is that, not only is the dreaded “commoditization” not occurring, but also that there has been a massive, and mutually beneficial, expansion of the number of SMBs and mid-market firms buying Managed Services.

It also means that if you use the proper operational methods – as we say if your Operational Maturity Level™ is high – you can make great money, just as the top quartile always have!

Which brings us to our next point.

Fix the Model, Then Expand

It’s no harder – though it is cheaper, quicker and less risky – to “re-break into” the market you’re already in again, than to break into a different market.

If you’re seeking a new market because growth or profitability has stalled out, taking your current less-than-optimal growth and profit tactics into a new market – where as we have seen the competition is just as stiff – is not likely to produce a different result.

Let’s look at the decision-making of those who successfully operate true multi-location Solution Providers – that is, those with 10 or more locations and who have Median-or-better profitability and are growing at the whole-company level.

These executives are accustomed to being persistently badgered by those of their General Managers whose locations are not performing, to be given permission to open a new location: “My market is tapped out. Let me open another location,” says the under-performing GM, “Then I’ll be profitable.”

The executives of successful multi-location companies have a common response to this (usually heartfelt and desperate) request: “Fix the model, then expand.”

- They know that if one of their General Managers isn’t successful in their current market, the same General Manager with the same skills and methods, is unlikely to be successful in the new one.

- They also know if they grant that under-performing General Manager’s request for serious new investment, they will be inundated with the same requests from their other under-performing General Managers, each with their own pet scheme for opening a new market.

- They know from hard experience, the only General Managers you reward with new geography and new investment, are the ones successful in their current markets.

The great news is, by becoming more operationally mature, the low-performing managers also can succeed in their current markets! They just have to acquire the best practices and put them to work!

The successful multi-location companies know this because if the current, failing General Manager sadly cannot improve, and he or she is replaced by a General Manager who is more operationally mature, the same “terrible market that cannot be turned around” is in relatively short order, made into a successful one.

Conditions to Opening Another Location

Once you have fixed your profit model in your current location(s), there are several conditions under which opening another location might then be a good idea:

-

Your growth rate in your current market is at or above the average for firms in your Predominant Business Model, and

-

Your growth rate is at or above what is needed for your current five-year Value Creation Strategy, and

-

You have sufficient cash and cash flow to invest substantial funds in opening a new location and have it utterly fail, without materially harming your current operation or putting you in a compromising debt position.

You will notice these are a series of “and” conditions: They all need to be true for opening a new location to be a good idea.

To proceed without all three being positive, is likely putting the organization itself at material risk. It also indicates that you likely do not have sufficient resources – time, money, people – to help the new location succeed.

Growth Potential in Your Current Market (or a New One)

What is the growth potential in your current market, for the operationally mature Solution Provider? We ask this question now, because we’d advise you to analyze your current market to understand how much opportunity you already have for growth, without the risk and expense of opening a new location.

Obviously, you can also use this analysis on a potential new market, if you have met the conditions we have cited above, for considering opening a new market.

The potential for growth in your current market (or a new one) is pretty easy to figure out.

The U.S. Census Bureau counts not only people, but businesses as well. Each year, they publish detailed spreadsheets showing the number of businesses (and offices, since many businesses have more than one office) in the top 40 markets (“Metropolitan Statistical Areas”, as they call them) as well as dozens of what they call “Micropolitan Statistical Areas”. They break out the count by number of businesses (and offices) with:

- Under 5 employees,

- 5 to 9 employees,

- 10 to 19 employees,

- 20 to 99 employees,

- 100 to 499 employees and

- 500 and more employees.

(To find the U.S. Census data for your specific geography, go to this page: https://www.census.gov/data/tables/2017/econ/susb/2017-susb-annual.html and scroll down to Metropolitan Statistical Areas (MSAs). Most other nations have similar census data.

Obviously, this is accurate enough for SMB and lower-mid-market business planning. But it gets even better: They also break these down into vertical markets. It’s useful data galore! Best of all, you already paid for it.

Of course, not all these businesses are ripe for great services and solutions. Remember that high OML™ Solution Providers (i.e. the ones in the top quartile of growth and profit) only pursue customers who want the “full meal deal”, an offer which appeals to about 25% of the client decision-makers in any given market.

However – and this is why the high OML pursue them – these uncommonly smart decision-makers each spend on IT about 2x to 5x what each of their more common but less-smart peers do.

By focusing on these smart decision-makers, the high OML:

- Earn much more Revenue per contract, which means they grow bigger faster with lower sales costs than their lower OML peers who mistakenly believe that any customer is good to win.

- Deliver higher quality and more differentiated service because they control much more of the customer’s technology stack and operating processes, as well as have the tools, methods, permissions and billing in place to deliver great service, which is what their smarter-than-average customers want in the first place.

Thus, you have to take the Census Bureau data and reduce it by about 75%. Thankfully, there are so many SMBs and mid-market companies that there’s plenty to go around even in targeting only the “smart 25%”.

As an example, let’s focus on the SMB space, and on Managed Services1, and use Louisville, KY, if only because it’s the 30th largest metro in the country, putting it squarely in the middle of Tier Two:

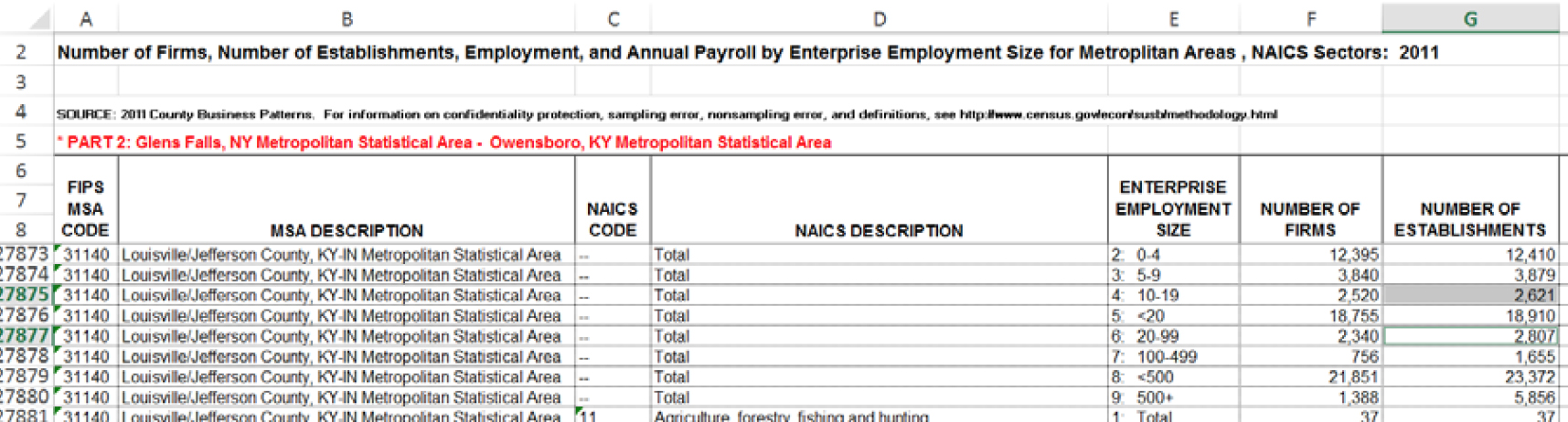

As you can see, the Census Bureau says that in this market:

- There are 5,428 establishments (business locations) with between 10 and 99 employees; the target “SMB” size range.

- Of these 5,428 establishments, we can safely assume about 25% or 1,357 smart ones, will buy the “full meal” Managed Service deal.

- The average price for a fully managed environment coming from an OML 4 MSP is about $175 per employee.

- The average customer in the 10-99 employee range is about 25 employees.

- Therefore, the OML 4 MSP gets about 25 x $175 x 12 months = $52,500 per year for each deal they close.

- Therefore, the “Total Addressable Market” (or “TAM” as it is known) for an OML 4 MSP is about 1,357 customers times about $52,500 each equal about $71,000,000.

- Since we have not yet added in product and projects, let’s toss in another 50% (the average MSP’s proportion of product and project Revenue) and say we’re at about $142,000,000 in TAM in Louisville.

Yes, the 1,357 smart SMB decision-makers in this market are indeed spending about $142mm on IT infrastructure products, projects and operating services, each year.

The average MSP in 2017, remember, was about $4.7mm in Revenue. That means the average MSP in this market:

-

Had about 3.3% market share ($142mm / $4.7mm = 3.3%),

-

Could triple to nearly $15mm in Revenue and still have less than 10% market share.

In our master database, we show nearly 200 IT companies in Louisville. If we “scrubbed” the market on behalf of a buy-side M&A client or Private Equity group, we would probably double that number.

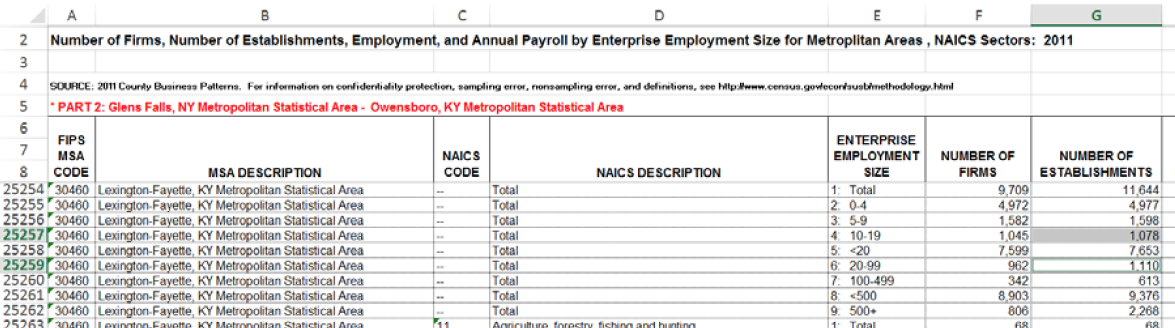

Should our fictional, Louisville-based MSP – who wants to accelerate growth – open an office in, say, Lexington? Lexington is 78 miles or 1 hour 22 minutes from Louisville, as Google drives it.

Lexington is a smaller town, yes, but a smaller town means less competition, right?

Well, no. Our master database shows nearly 60 IT companies in Lexington, and again, if we researched it, we could probably double that. And here’s what the Census Bureau says about Lexington:

There are about 40% as many SMB establishments in Lexington and – no surprise – about 40% as many IT companies, as in Louisville.

Lexington is no more underserved than is Louisville. Given that the competitive landscape is about equal, why would our fictional Louisville company risk the expense and distraction of opening an office in Lexington when they only have 3.3% market share in Louisville, a market they know much better and which knows them better?

Does our fictional Louisville company think that somehow the MSPs are less capable (i.e. lower OML) in Lexington and therefore easier to beat? Again, the Service Leadership Index says “No”. No geography has a materially disproportionate number of higher or lower OML players.

But if our fictional Louisville company is truly, say, an OML 4.2, why not go trounce the lower OML guys in Lexington? Because, of course, there as proportionately just as many low OML guys in Louisville to trounce!

Now, the Private Equity guys love to invest in companies which take advantage of what is called “The Law of Large Numbers.” Meaning, they would prefer to buy a company which is profitable and growing fast but which has, say, only 0.33% of the TAM instead of 3.3%. This is because they know how hard it is to win and keep market share.

Therefore, they might look at the 3.3% market share our fictional Louisville MSP has, and say, “Well, 3.3% is a large proportion of the market, so it’s pretty hard to get to 10% share, so I don’t want to be there.”

That’s a correct opinion when you have hundreds of millions to invest, across multiple investment plays, more or less at whim.

But it’s irrelevant to the MSP owner who wants to get to $10mm and do it essentially on cash flow. Private Equity guys play “win or bust” and go for $200mm in Revenue by spending gobs of someone else’s money. The MSP owner doesn’t often play that way, and rightly so.

To summarize:

- If it is going to be a ground war whether we fight it here in Louisville or 78 miles away in Lexington, and

- If every account has to be taken the old-fashioned way, with hard work, a great reputation and great service,

- Why not do that work here, in Louisville, where we know the terrain, the competition, and the natives, and we can sleep at home every night?

The fact is, the “smart 25%” of decision-makers, want the full meal deal and they want great service, and they’ll pay well to the high OML companies that can deliver it.

The results say this strategy wins more than its fair share of the market, in any metropolitan or micropolitan area, in any country, on any continent.

Learning from Success and from Failure

Let’s learn how to successfully open a new location, by looking at what normally succeeds and normally fails.

The Indispensable Ingredient for Success in Any Location

A critical lesson for opening new locations is to note one of the key reasons our first location succeeded: The principal (the owner, you) was located in that town.

Like most IT Solution Provider owners, you’ll roll your eyes at this one and say, “Oh no, I can’t be everywhere. That’s not scalable!” That’s true (and it’s solvable through another best practice we call “Principal-Led Selling”, not the subject of this paper).

But let’s look at why principals (owners, you) are so effective at selling, and why (without the principal-led selling model noted above) that success is so hard to replicate with a sales team.

In all markets, targeting any customer size, by any Solution Provider size, IT services and solutions are best sold – most safely and with the most value for both parties – C-level to C-level. Why?

Because IT solutions (products plus the services to implement them) and services (operating services like break/fix, Managed Services and Cloud services) are intangibles. Professional services and support services are not manufactured items which come from a literal factory and are received at the customer’s literal loading dock.

Instead they are the craftsman-like efforts of skilled people who are attempting to meet the customer’s often poorly expressed needs, too often poorly interpreted, and which to be successful often require desired but unpredictable behavior changes from the customer’s employees and executives.

In addition, the smart customer decision maker knows they (and their people) are not well-qualified to determine whether or not you have the technical acumen to successfully deliver the solution or service.

As a result of these two factors, the smart customer C-level knows that the decision of who to go with for a new solution or service, largely comes down to trust. Specifically, trust between themselves and their peer C-level in the Solution Provider company.

Given that, let’s now look at the sales cycle for these intangible solutions and services through the smart customer decision maker’s eyes, in two scenarios. First, with you, the principal/owner, as the lead salesperson and second, with a good (though not rock star) sales rep leading the sale.

First, with you (the owner or principal) leading the sale:

- I’m the customer decision maker. I meet you at a community charity event. I decide I might be compatible with you.

- We meet at my office and talk about the needs, the solution or service, the timing and the budget. I’m an expert in my business and you’re an expert in yours. We’re both skilled business people.

- I decide I trust you.

- We shake hands. I commit my firm and you commit yours.

- The paperwork is a formality.

This is a very efficient sales process for both of us. It is as fast and as safe as it gets in the intangible world of IT solutions and services.

Now let’s look at it the second way, where you approach my firm with a good (though not rock star) sales rep.

- My people and I get dozens of “touches” from your marketing. I’m pretty sure I never asked to be “touched”, nor can I easily discern between your marketing and your competitors’.

- Your sales person finally breaks through to someone on my staff. I may or may not have instructed them to respond to you.

- I am unlikely to let the first conversation be with me directly. I know instinctively or from experience, that having a conversation with your sales rep will be an inefficient use of my time:

- The odds are good your sales rep doesn’t understand business, profit and loss, the needs and constraints of leadership, and so on.

- The odds are good your rep doesn’t understand your solution or service in detail.

- These two factors make it likely that your rep’s idea of what is a “solution” for my business is standing on shaky ground. Your solution could be a good one but it’s unlikely your rep can judge whether it’s good for me.

- It would be great if your rep were so good that 3a and 3b were not true. However, even then, most sales reps (thankfully) don’t have the authority to commit their firm. So, there’s at least one more meeting to go, where my peer (you, the decision maker in your firm) will be participating.

- There is likely to be a fair bit of back-and-forth between our firms before that C-level to C-level meeting occurs.

- Eventually we get to an agreement.

Five short, simple steps as compared to six or more convoluted, lengthy ones. If you’re sending in a sales rep, but the owner of your competition meets me at a community charity event, you are probably going to lose.

(A rock star sales rep may overcome these obstacles, because they immediately demonstrate an above-average or high degree of understanding of my business, which helps me feel more comfortable that your solution or service might be well-suited to me, and they have an above-average degree of gravitas, presence, personal persuasiveness – whatever you want to call it – that convinces me that they can in fact carry out within your firm, what they have committed to me. Those are rare reps.)

Meanwhile, back at your office, you (the principal, the owner) are indeed commanding the troops to deliver what you – in our short, effective, brief interaction – have committed to doing for me. And you are keeping people, process and tools aligned so that you can continue meeting that commitment and make a fair profit, which I want you to do.

This is why your first location was a success: You (the principal, the owner) were (and are) fully engaged with prospect and customer decision-makers in over and over in the shortest and most efficient sales cycle possible.

The point, of course, is that second locations rarely succeed unless there is someone who can act in the principal role, full time, physically, in that location. In that new city, the C-level decision-makers who are smart, want to meet that person before they make a buying decision. Conversely, the customers in that market who are willing to make a buying decision without meeting a principal, are likely not smart enough about IT to make good customers.

There aren’t enough principals in your company to have one in every location, and in many cases, it is not wise to add more principals. We’ll solve this in a moment.

Contrast this with the most common method of opening a new location:

- Hire a sales rep and perhaps a tech there,

- Carpet-bomb the city with marketing, and then,

- Hope and pray.

If the rep is a self-starter and has a high activity level, then at least appointments will begin to happen. They will be unlikely to be with C-level any time soon, but eventually some will be.

As noted above, however, the customers who are willing to buy without meeting your C-level, and also to buy from a company new to town, are unlikely to be smart enough about IT to make good customers. In addition, most sales reps are not good at effectively communicating to prospects what you can do well or at communicating to your team what they have committed to.

As a result, efforts to deliver quality with controlled COGS and sales cost, are likely to be hampered. Without quality, referrals do not come, and the sales rep will lose confidence, the death knell of future sales.

If the rep is not a self-starter and is not good at generating meeting activity, well, we know that outcome.

These are the reasons the typical approach to opening a new market do not work.

Eleven Rules for Opening a New Location

Based on the lessons we can take from your initial success in your first market, and from those who have succeeded in opening and operating new markets, let’s outline the rules for opening a new location.

-

Distance from main location – The new location must be close enough that you (the principal, the owner) can wake up at home early in the morning, get to that location and have 3 to 4 meetings, and get back home in time for a late dinner. If it is any farther than that, you will not go often enough to make the location successful. This is part of the way you solve the “not enough principals” problem.

-

A key second benefit is that this will mean the second location is close enough geographically that it will be of value to someone who wants to buy your company; distant locations often reduce stock value and decrease attractiveness.

-

Who to hire - The first people you employ in the new market must be successful current employees transplanted from your first market. That’s right: Your best and brightest need to leave the nest and go make a home in the new market. And your nest must not only be willing and able to do without them, but also to support them in the new location. Proper process and policy, good culture and communications, are much more likely to be successfully established when carried into market by your prized pioneers

-

Getting good early traction - Prior to deciding where (in what city) you will open the new location in, you must analyze your current customer base to determine how many of your current customers themselves have branch offices in the potential new locations and will give you business there right away. The potential new city which has the highest likely Revenue from existing customers, is most likely the winning choice, both due to early cost offsets as well as early local references and referrals.

-

Implicit becomes explicit, habit becomes DNA - Hopefully, you are very good at documenting processes and have thoroughly documented how your business runs today. That’s because it’s not only essential to scaling in your current market, but because it puts you about half-way to being well-documented enough to successfully open and operate a new location. One reason you are sending your current good people to live in the new location is that much of the knowledge about what we do and do not do, and why, is still implicit, that is, we have not documented it yet. But even they must be bolstered with as much explicit documentation and training as possible. If most of your operating methods are still implicit and you’ve only documented the “tip of the iceberg”, don’t open the new branch!

-

Be able to afford to invest, patiently – Generally, it takes 2 to 3 years for a new location to become profitable, that is, to throw off positive cash flow which can be used to support not only its own future, but perhaps support other new initiatives in the company. That means cash flow from the rest of the organization must be able to reliably support the new location for a long time. Opening a new location is a venture-capital level of risk; it has high potential return but it also has a high chance of failing. The value of investing in opening a new location must be compared to the value of investing in other new initiatives the company is considering for defensive or offensive reasons. You only have so much money and so much senior management time. If you do decide to invest in opening a new location, and it isn’t trending towards profitability, even if only slowly, re-look at your ability to invest to re-implement Rules 1, 2 and 3 again. Make hard choices.

-

Someone must be in charge – Once the new location gets up to about 5 or 6 people, someone there must be in charge. Minimally, that person should be a transplant from the mother ship and should be in charge of sales and service. Sales and service people have a dotted line to their respective leaders back at the main location, but they have a hard line report to the local leader they work with day-to-day. Humans need a local leader. The local leader provides the daily direction, guidance and problem solving, as well as the authority in front of the prospects and customers, while the business unit leads back at the main office provides the methods, best practices and support.

- The local leader needs to act as principal. See “The Indispensable Ingredient for Success in Any Location,” above.

- The local leader doesn’t need P&L responsibility until the location gets to 20 or so people.

- The local leader does need to know and buy into your offerings, qualification and pricing, in detail (see Rule 7, below).

- Remember, though, that appointing the local leader does not diminish the frequency with which you, the principal or owner, must physically visit the location. To grow, and stay growing, locations need the full and constant participation of senior leadership.

-

No new offerings or methods – One of the great strengths of well-running multi-location companies (though unfortunately there are many who do not run well) is that they use the distributed brainpower of the different locations as Petri dishes, if you will, to grow new offers and best practices which can then be used across the company. However, seemingly paradoxically, the only way to be successful with this is to make it very difficult for any location to come up with a new offering or method. This is because most new ideas aren’t very good; most peter out very quickly in the real world. So, the locations must demonstrate that they can succeed well with the already-proven formula, before they can start adding to or tinkering with it.

- The most common refrain of failing location managers is, “It may work in your market but it doesn’t work here!” Nonsense: Re-apply what we do here, and it will work there. Or find a new job.

- The same applies to hyper-successful location managers: Great success doesn’t mean they can do things their own unique way. The location isn’t their company to run; it’s their location to succeed with, using the company’s methods. Their future success depends on getting the main location and their peer location managers to willingly adopt their way of doing things, not on going rogue.

- An important corollary is that no location other than the main one, can have “back office” functions. This includes obvious things like marketing, accounting and finance, human resources, legal support, IT support and major internal systems, and customer-facing functions like Network Operations Center and Service Desk. Less obvious but usually better off centralized until the second location gets quite big, are possibly things like service dispatch and recruiting. The new location has field sales and service responsibility; that’s it.

-

The same Target Customer Profile (TCP) must be pursued – It is hopefully obvious in Rule 7, but it’s pivotal to your success, so we’ll call it out separately here: The TCP you intend to pursue in your new market must be the same as you pursue in your current market. Otherwise, your marketing material might apply, but your people, skills, tools and processes will not apply. Your odds of succeeding with two different TCPs in one market are low; your odds of doing so in two different markets are lower.

-

Thought leadership marketing – If your only lead generation methods are SEO, emailing, calling and shoe leather, you’re unlikely to be successful at ramping Revenue fast enough. Thought leadership marketing in your new market is even more important than it is in your existing one. You – the principal or owner – must be speaking at business events, attending charity events, giving interviews and publishing or being cited in articles, in your new city. It is critical that smart decision-makers can look you in the eye and hear your train of thought. This is another part of the way you solve the “not enough principals” problem.

-

We succeed together (training, job rotation, planning meetings and celebration) – If the critical activities of training, job rotation and planning meetings were simply ways to ensure that the desired outcomes of Rule 4 were successfully met, we would make them a sub-bullet there. But there is more at stake here. Too often, an “us versus them” mentality develops between the first location and the second which severely hampers the likelihood of success of both locations.

- From the first location’s point of view: Some of our best friends left us to start a new life; we have less help here than we did before; the new location seems to resist doing things correctly; they’re sucking up investment dollars which are desperately needed here; the boss seems to spend more time with them that he or she does with us.

- From the new location’s point of view: The people at the main office don’t understand that the people and customers are different here; the main office has tons of resources around and doesn’t understand that we don’t; the main office seems to alternate wildly between paying no attention to us and micro-managing both important and unimportant things; the main office (or other offices) get more investment than we do, even though our job is harder because we’re newer; the boss spends more time at the main office (or some other office) than he or she does here.

- Therefore, it’s critical that, in addition to transplanting your best and brightest to the new location, you bring the new people hired at that location – and the transplants – back to your main office frequently for training, job rotation and planning meetings. This applies to all levels and roles at the new location. Toughest to accomplish is job rotation – having two people in the same or similar roles switch chairs for a week at a time, or at least have the one person come and visit the other person for some side-by-side work. This can be an emissary from your main location going out to the new location as well as a person from the new location coming to the main office. Obviously, this is going to be strain on resources, but it will ensure more efficient and effective operations in service to each other and to customers. Most importantly, it will help quell the “us versus them” tendencies common to any multi-location operation.

- Shared celebration is also critical. When the new location wins a new deal, an announcement is made from the main office celebrating their accomplishment but also noting everyone who contributed, including those at the main office. Similarly, when the main office wins a deal, it puts out an announcement (of course also citing any help from the new location), but the wise manager at the new location will put out their own congratulatory message in response, recognizing the accomplishment of the main office. The point is: We are in this together, we are all sacrificing to grow the success of the company and to provide even more opportunity for ourselves in the future. We succeed or die together.

-

As hard as the second location is, the third is just as hard, then it gets somewhat easier – When establishing your second location, documenting and externalizing all of the implicit processes and policies by which your company operates, will feel like being wrung through the wringer. Having successfully documented things enough to get a second location off the ground, you’ll have done so thoroughly enough that you will only need to expend the same amount of effort over again, to open your third location. If you can successfully run three locations and at least make some profit, then you’re likely a proper multi-location operation, and opening fourth, fifth and so on locations from there, will be somewhat easier.

-

Remember that the profit performance ratios of the top quartile multi-location operations in the Service Leadership Index are the same as those of the top quartile, single location operations.

If you abide by these eleven rules, you’re not guaranteed to be successful in establishing a new location, but you’re more likely to be. These are the methods used by those who have most often succeeded in the past.

There are further nuances to evolving a successful multi-location operation – matrix management, proper P&L structure and allocations, career pathing, centers of excellence, incentive compensation, and so on – but following these eleven rules will get you off on the right foot.

Cases in Point

We’ll close with a couple of examples of Solution Providers who got it right.

A Tale of Three Cities

In this first case, the Solution Provider got it wrong and then applied more of the rules above and got it right.

The two owners had known each other since childhood and built the business together, starting with two locations in two cities about a 90-minute drive from each other. They were equal owners, and one lived in one city, while one lived in the other. One had sales and the strongest leadership skills and the other had the best process and financial management skills.

So, they immediately, out of luck, good instincts and/or strong understanding, met the requirements of Rules 1, 2 and 6:

-

They had someone in each location responsible for meeting prospects and working with customers, for ensuring company methods and policies were respected.

-

The locations were near enough each other that one owner could in one day get to the other’s location to apply their leadership, knowledge and skill, and still get home in time for dinner.

Over time they developed an implicit understanding of Rules 4, 7, 8 and 9. They understood that one location’s success meant success for the other, that back office functions could only be built in one location, that new offers had to be developed such that they would work in both locations, and that the company must engage in thought leadership marketing equally in both cities.

They became successful and wanted to extend that success to other markets.

They decided to mitigate their risk by buying a company in a third market, which had existing Revenue, instead of opening a greenfield operation. There is nothing wrong with going the acquisition route, as long as the eleven rules above are applied.

However, once the acquisition in the third city was made, things did not go well. They purchased a company about 1/10th their Revenue size, which was prudent. However, several factors mitigated against success:

-

It was not very profitable when they bought it, which they knew in advance. But it meant the local team, and, most importantly, the former owner who stayed on to become location manager, had little experience or track record at making money.

-

It was about 350 miles away from both of the existing locations, so the two acquiring principals didn’t visit it as often as they should have, nor did people at the acquired company visit the two existing locations often enough.

-

The acquired location only served one of the two Target Customer Profiles that the two existing locations served, so only half of the resources and methods the company had, could be applied to the acquired location. Having two TCPs was already stressing the company and adding a third location which only served one TCP, exacerbated these stresses among the management team and further diluted investment in both TCPs.

-

Because the two original locations had grown up simultaneously and were run by two owners who were very closely aligned, many of the operating processes used by the company were implicit, not explicit. Although they had two locations, their level of process and policy documentation was about as incomplete as if they had only one location. Thus, they were unready to extend those processes successfully to the acquired location.

Although barely profitable when they bought it, the location quickly fell into negative profit after the acquisition, because the former owner, now location manager, struggled even harder under the additional responsibilities of interfacing with the new company and adopting new (mostly undocumented) methods and offers.

On about $3mm in Revenue and virtually no growth, the newly acquired location then posted a series of years in which it lost between $300,000 and $400,000 at its bottom line.

The two original locations of the company, thankfully, continued to grow and to make good profits, so the losses at the third location were sustainable but highly undesirable.

The owners didn’t want to shutter it yet, so something had to be done to fix it.

The alert reader will have diagnosed the four bullets above and spotted violations of all or part of Rules 1, 2, 4, 6, 8 and 9, and possible violation of Rule 3. The company may have been in compliance with Rules 5, 7 and 10, and Rule 11 didn’t really yet apply.

The owners came to realize this, and also correctly came to realize that the single biggest challenge was correcting the violation of Rule 1. If the issue of physical proximity could somehow be resolved, then the other rules could more effectively be met.

The third location could not productively be physically moved closer to the other two locations. Also, the third location and one of the two original locations were in Tier 3 cities which could only be flown directly from one location. So additional airfare, even if tolerable, would not satisfy Rule 1 for the owner in the Tier 3 city. He could not get to the third location in one day and get back.

The solution, happily, came in the form of satisfying one of the owners’ long-time desire to learn to fly as a hobby. He was the one with the stronger process and financial acumen, and so served as the company’s CFO. As such, he was keenly aware of cost, and was sheepish to admit not only of his long-time interest in flying, but to assert that the high cost of buying and operating a private plane might actually have a business benefit.

Nonetheless, they took the chance and bought a used, pressurized, twin-prop plane, and he started to learn to fly (on his own time of course).

Meanwhile, they immediately took two steps to get benefit from the expense. First, they arranged to hire a pilot and charter out the plane every Tuesday, Thursday, and weekend the owner/CFO wasn’t using it. This, to their great pleasure, covered the expenses of owning the plane.

Second, they retained the pilot to fly a rotation between the three locations every Monday, Wednesday and Friday morning and evening. This allowed not only the principals to easily and nearly spontaneously meet Rule 1, but also to start a critical rotation of pre-sales engineers, billable people, administrative and management resources, to circulate fluidly between the locations, bringing the full benefit of the company’s resources to the previously isolated and starved third location. Some of the third location’s few key engineers were even called on to support sales and deliver work in the two original locations!

Immediately, Revenue in the third location started to grow. Commonality of offers, methods and practices improved, creating further leverage. The average size and richness of deals in the third branch started to grow towards that attained by the two original branches. Training, job rotation, career pathing and planning meetings all increased in frequency and effectiveness.

In the first year after the plane was purchased, the third location attained a $300,000 bottom line profit, after having lost the same amount the previous year. This represented a $600,000 positive swing to the company’s bottom line, from a $250,000 investment in a good used plane.

At the end of that year, the CFO asked us if we thought they had made a good decision in buying the plane. He knew that the cash flow impact had been strongly positive, but he wanted an outside, objective opinion. Obviously, our answer was, “Yes!”

It didn’t hurt that we also reminded him that every cash flow dollar resulted in (at the time) about a 6x increase in stock value. So, the $600,000 improvement in cash flow also meant an increase in company value of about $3.6mm (net of the cost of the plane, of course, which could be resold at any time).

Here’s to fulfilling long-held desires for hobbies! And here’s to following the eleven rules for safely opening and operating an additional location.

The Best and the Brightest

In this case, the Solution Provider had only been founded a few years earlier but shown strong growth from the start. The founder in this case was already near OML 5; he was past 70 years old and was recently retired as head of worldwide professional services for a $90bb IT equipment manufacturer, a household name. That alone would not necessarily make one OML 5, but in his case, he was.

Having to retire from his life-long employer didn’t mean, however, he had to retire from the IT services business. He started his own company, on a shoestring, but after only five years, he was at $25mm in services and growing quickly and profitably.

He was operating in four cities. In reviewing his choices of geography, which were not typical, we asked, “What demographic or economic analyses did you do, to arrive at these choices for office locations?’

He said, “I don’t do any analysis, beyond making sure the market isn’t farther away than I want to travel in a day.

“I just go looking for someone who has built a small IT company – say, $4mm to $5mm in Revenue – and sold it. Someone who can do that, I can teach. I just look until I find one that wants to learn from me, wherever they are, and I hire them as principal in charge of whatever city they’re in.

“I turn them loose, and I teach them how to run the business at the next level, and the next one after that.”

He followed Rules 1, 6, 7, 8 and 9. Most important of these, was Rule #6: Someone Must Be in Charge. The ingenuity of his approach is that he sought and hired people who had proven they could build a business at least once.

As always, it comes down to the leadership.

ABOUT SERVICE LEADERSHIP, INC.

Service Leadership is dedicated to providing total profit solutions for IT Solution and Service Providers, directly and through industry consultants and global technology vendors. The company publishes the leading vendor-neutral, Solution Provider financial and operational benchmark: Service Leadership Index®. This includes private diagnostic benchmarks for individual Solution Providers and their business coaches and consultants. The company also publishes SLIQ™, the exclusive web application for partner owners and executives to drive financial improvements by confidentially assessing and driving their Operational Maturity Level™.

Service Leadership offers advanced peer groups for Solution Providers of all sizes and business models, and individual management consulting engagements for Solution Providers from US$15mm to US$3bb in size worldwide. In addition, Service Leadership provides global technology OEM with advanced partner enablement assets, partner ROI models, management consulting and advanced peer groups, as well as executive and industry best practices education and speaking. Please visit www.service-leadership.com for more information.

Notice: All materials published (electronically or print) by Service Leadership are proprietary and subject to trademark and copyright protections, regardless of where and how it is sourced. The terms and concepts of SLIQ™, Service Leadership Index®, (S-L Index™), Predominant Business Model™ (PBM™), Operational Maturity Level™ (OML™), Normalized Solution Provider Charts of Accounts™ (NSPCoA™), Total Cost of Managed Services™ (TCMS™) and Service Factory™ are proprietary to Service Leadership, Inc. All Rights Reserved.

1 However, the same analysis that applies to MSPs also applies to Product-Centric and the other eight Solution Provider Predominant Business Models.